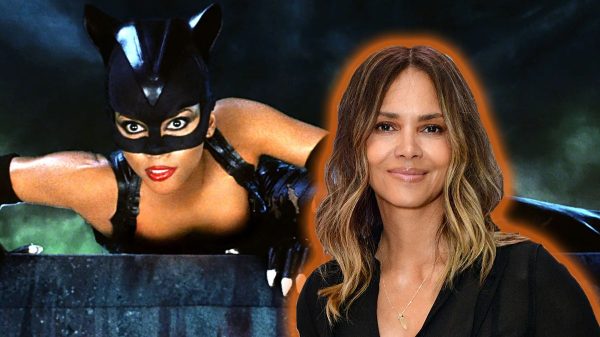

‘The Big Short’ is not just a film; it’s also a financial chronicle that shines a light on the 2007-2008 financial crisis — an event that reshaped economies worldwide. Released in 2015 and starring Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt, this Oscar-winning screenplay provides more than just a narrative; it features critical financial lessons. Here are six lessons from ‘The Big Short’.

Understand the Real Cost of High Risk and High Reward

The film shows us the consequences of underestimating risk in pursuit of high rewards. It’s a cautionary tale of banks lured by the initially lucrative subprime borrower market, only to face catastrophic losses when default rates skyrocketed. So, while high rewards may seem enticing, they often come with equally high risks.

Timing is as Important as Being Correct

Christian Bale’s portrayal of Michael Burry reveals a reality: being right isn’t enough if the timing is off. Burry’s accurate predictions of the housing market crash were initially met with skepticism and financial strain. What we can learn from that is that in financial markets, timing your moves is just as critical as making the right call.

Do Your Own Independent Research

‘The Big Short’ reveals how even professionals in the mortgage industry failed to recognize the housing bubble, as they were blinded by optimistic incentive structures. This wasn’t necessarily due to malice but possibly due to an environment that rewarded short-term gains, overshadowing long-term foresight. Thus, it’s important to conduct your own research rather than taking professional advice at face value.

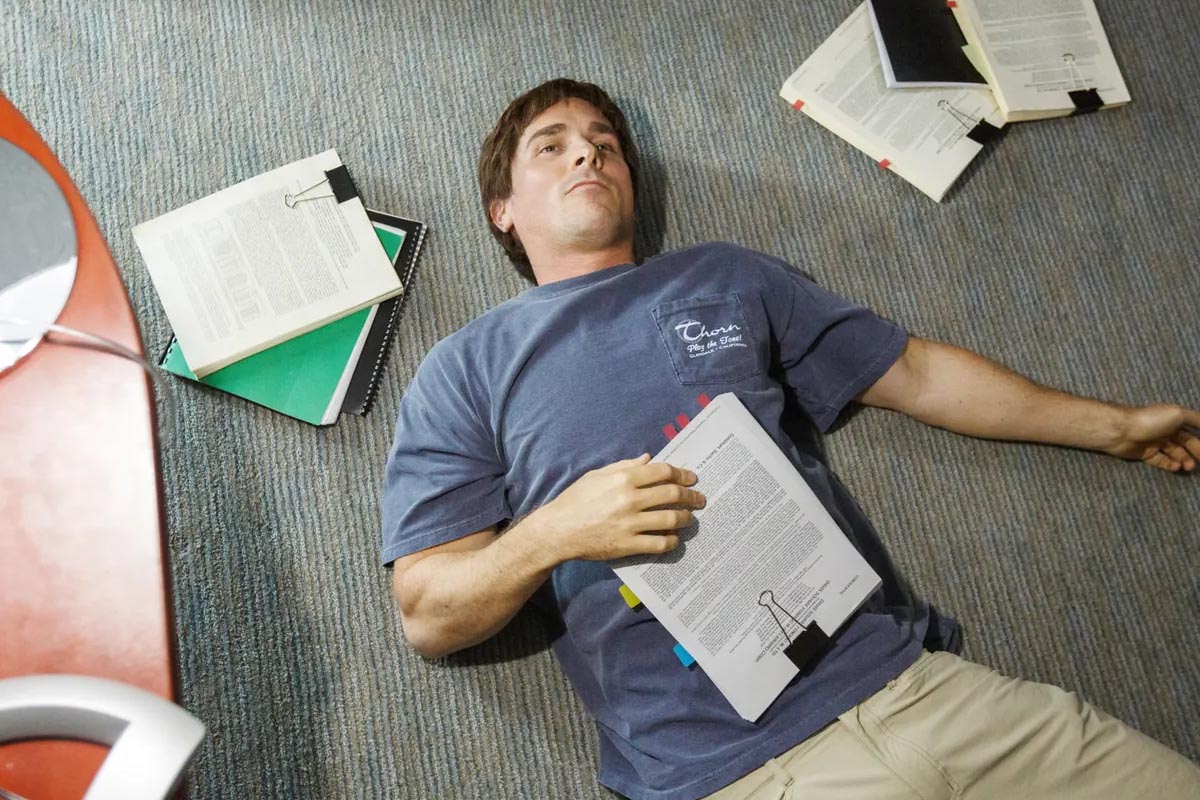

Verify Your Analysis Meticulously For Sound Investment

The movie encourages viewers to adopt a meticulous approach to financial planning and decision-making. Double-checking analysis and investment ideas is crucial, a step often neglected, yet essential to avoid miscalculations and oversights.

Seek Opportunities, Even in a Crisis

Amidst the chaos, ‘The Big Short’ portrays characters who find a silver lining. When many saw catastrophe, a few discerned opportunity. The lesson to learn from is even during tumultuous times, there are chances for growth and profit for those with the insight to identify them.

Challenge the Status Quo

‘The Big Short’ advocates for a healthy skepticism in financial dealings. What it encourages is not to accept information at face value and to question the validity of the advice they receive. This reinforces the value of critical thinking in decision-making, especially when it comes to investments.